Achieving financial independence before the age of 40 might seem like a distant dream, but with the right strategies, discipline, and planning, it can be a very attainable goal. Financial independence means having enough passive income to cover your living expenses without relying on a traditional 9-to-5 job. It offers the freedom to pursue your passions, travel, start a business, or simply enjoy life without financial stress.

Achieving financial independence before the age of 40 might seem like a distant dream, but with the right strategies, discipline, and planning, it can be a very attainable goal. Financial independence means having enough passive income to cover your living expenses without relying on a traditional 9-to-5 job. It offers the freedom to pursue your passions, travel, start a business, or simply enjoy life without financial stress.

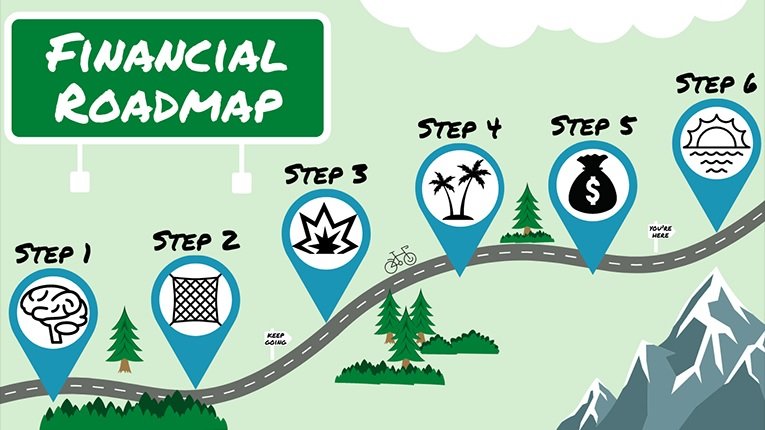

Here’s a detailed guide on how you can achieve financial independence before hitting your 40s.

1. Start with a Clear Vision of Financial Independence

The first step is to define what financial independence means for you. While most people equate it to not working anymore, the reality is that it’s about having the freedom to do what you want without worrying about money. It could involve:

- Retiring early and living off investments

- Becoming location-independent and traveling the world

- Starting a business or creative venture that brings in income

Set specific goals based on your lifestyle desires and financial needs. This clarity will guide you in making decisions as you move forward.

2. Track Your Expenses and Create a Budget

Understanding where your money is going is critical. You can’t optimize your spending unless you track it. Start by reviewing your income and expenses over the past few months. Use budgeting tools or apps like Mint or YNAB to categorize your spending and identify areas where you can cut back.

Look for ways to reduce unnecessary expenses. This might mean:

- Cutting back on dining out or subscription services

- Downsizing your living situation or moving to a more affordable area

- Switching to more budget-friendly brands

Living below your means is crucial for saving and investing toward financial independence.

3. Maximize Your Income Potential

While controlling your expenses is important, increasing your income is just as critical to reaching financial independence. Consider the following ways to boost your earnings:

- Negotiate your salary: Ask for raises and find ways to increase your value at work.

- Side Hustles: A side hustle, whether freelance work, starting an online business, or selling products, can significantly boost your income.

- Invest in Education and Skills: Continuously improving your skill set can help you secure higher-paying jobs or start a profitable business.

- Create Passive Income Streams: Income from dividends, royalties, rental properties, or digital products can supplement your active income and put you on a faster track to financial independence.

4. Save Aggressively and Invest Wisely

To achieve financial independence, you’ll need to save a significant portion of your income—ideally, 40% to 70%—depending on how quickly you want to reach your goal. The more you save, the faster your wealth will grow.

- Emergency Fund: First, build a solid emergency fund of 3-6 months’ worth of living expenses to ensure you have a safety net.

- Investment: The key to long-term wealth is investing. Put your money in assets that grow over time, like stocks, real estate, or bonds. Start by contributing to tax-advantaged accounts like 401(k)s, IRAs, or HSAs.

- Compound Interest: Take advantage of compound interest by starting to invest early and consistently. Even small, regular investments can grow significantly over time.

- Index Funds and ETFs: If you’re not an expert in stock-picking, consider investing in low-cost index funds or ETFs that track the market’s overall performance.

5. Avoid Lifestyle Inflation

As your income increases, it’s tempting to upgrade your lifestyle. However, one of the most common pitfalls people fall into is lifestyle inflation—the tendency to spend more as you earn more. To achieve financial independence, it’s essential to resist this temptation. Instead, keep your lifestyle relatively modest and allocate the extra income toward savings and investments.

6. Minimize Debt

High-interest debt, such as credit card balances or personal loans, can eat into your ability to save and invest. Focus on paying down any high-interest debt quickly and avoid accumulating more. If you have student loans or a mortgage, consider refinancing to get better rates or pay them off aggressively to reduce interest over time.

7. Automate Your Finances

Set up automatic transfers to your savings and investment accounts to ensure that you prioritize your financial goals before spending on discretionary items. Automating your finances will also help you stick to your budget and avoid the temptation to spend impulsively.

8. Build Multiple Income Streams

Having one source of income is risky and inefficient when aiming for financial independence. Build multiple income streams, including:

- Investment Income: Stock dividends, rental income, or bond interest.

- Freelance or Contract Work: A secondary gig in your field of expertise can provide extra cash.

- Side Businesses: Whether it’s selling products, creating online courses, or offering services, a side business can generate reliable passive income.

9. Embrace Minimalism

Achieving financial independence often involves adopting a minimalist mindset. Focus on the things that add value to your life and let go of the excess. This could mean simplifying your living space, decluttering your lifestyle, and focusing on experiences over material possessions.

10. Monitor Progress and Adjust

Financial independence is a long-term goal, and your plan will need to evolve. Track your net worth, investments, and financial goals regularly to see if you’re on the right path. Adjust as necessary—if your goals change, or your income increases, you may need to recalibrate your strategy.

Conclusion

Achieving financial independence before 40 requires planning, discipline, and sacrifice, but it’s possible for anyone willing to put in the work. Start by understanding your finances, saving aggressively, and making smart investments. As your wealth grows, you’ll find yourself closer to the freedom to live life on your own terms. With patience and persistence, financial independence is within your reach—so why not start today?